Pros

- New cars are too expensive for many buyers.

- Prices are higher than they were in 2021.

- Buyers have renewed interest in bigger vehicles (but not for long).

- Prices will likely continue to trend down.

Cons

- Prices are lower than they were this summer.

- If you wait too long, manufacturers may discount new car prices.

- If you sell right now, you may have to buy a new car while they’re expensive.

The average list price for used vehicles in December was $27,143, down from $27,156 in November and $28,193 a year before.

It feels like prices keep going lower, but last month, the average used car list price was about $7,000 more than it was in the spring of 2021.

Even lower prices aren’t stimulating demand for used cars.

Here’s What Cox Automotive Chief Economist Jonathan Smoke said.

“As the supply of new vehicles improves – and it is improving rapidly – demand for used vehicles is declining.”

But It’s not all bad news.

The Manheim Used Car index was up 20 points in mid-January compared to the start of the month but still down 10 points compared with December. That may not mean more cash in your pocket when you sell this month, but the smaller up and downshifts in the index show a little more stability than we’ve seen in the past six months.

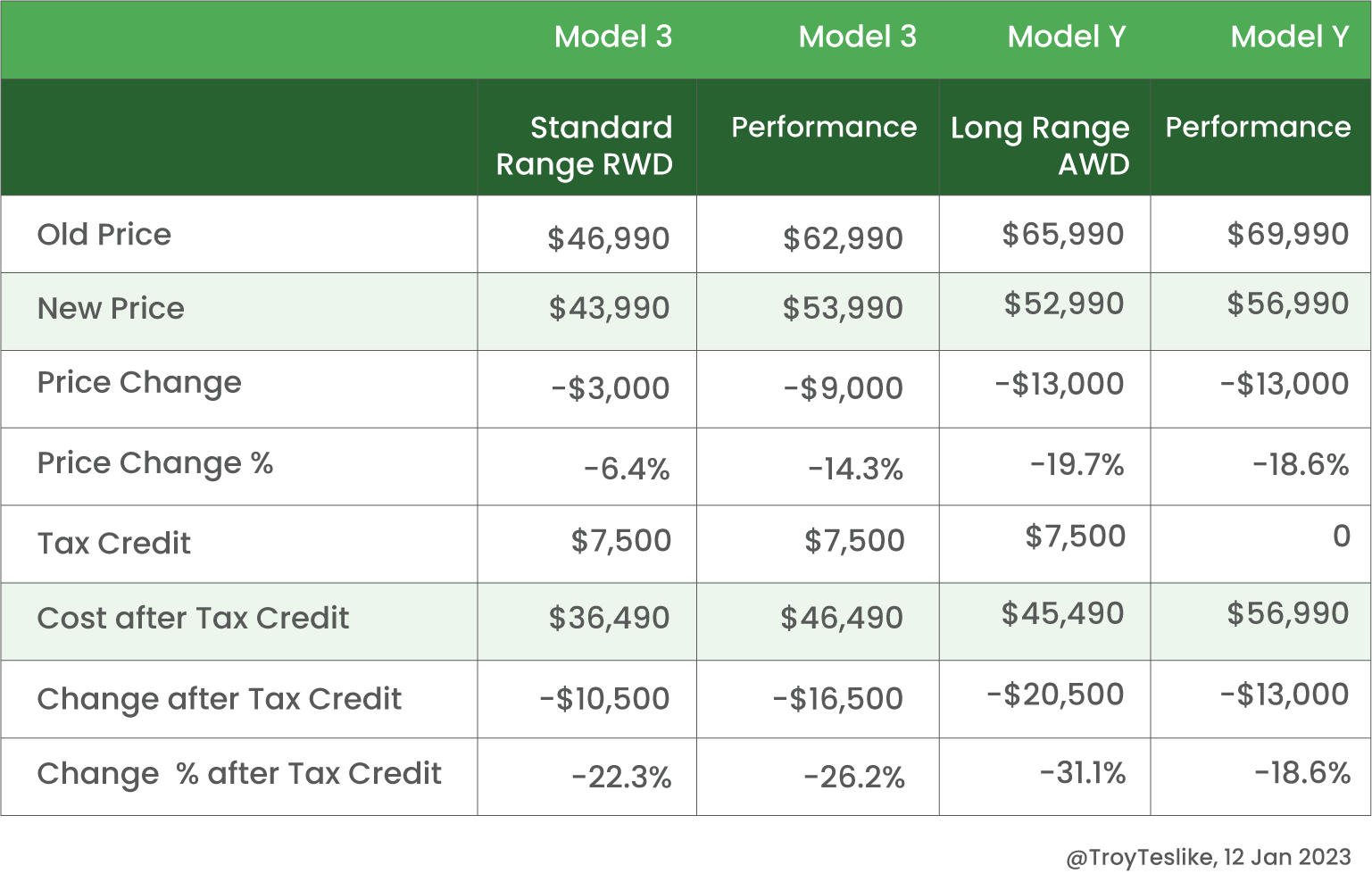

New Vehicle Prices Are Still High, Meaning many buyers will have to consider used cars.

New car prices are at an all-time high right now, with the average transaction price coming in at just under $50,000.

That’s an East Texas middle-class home in the 1980s.

Wild.

Since new vehicle prices are still high, folks who need a car are more likely to consider used options. This interest is good news for anyone trying to sell.

New Car Sales Are Mostly Stagnant

Those record prices are not without consequence. Dealerships and Auto manufacturers aren’t seeing their sales numbers improve.

Part of the reason new vehicles are in high supply is that they aren’t selling very well.

This could be because of record new vehicle pricing.

Vehicles were in such high demand last year that manufacturers didn’t need to run sales promotions, but that luck may be running out.

If manufacturers introduce incentives, that could drive down the demand for used cars. Less demand means less money when you sell.

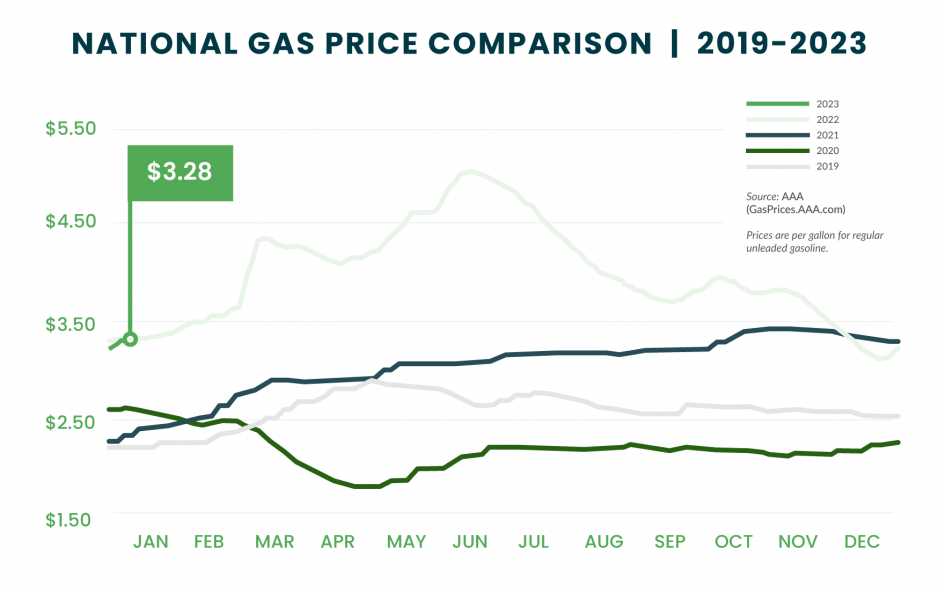

Gas Prices Headed Back Up

Steadily decreasing gas prices this fall boosted some segments of the used car market.

We’ve seen a great deal of rising demand for larger vehicles in the past two months after several months of abysmal large truck and SUV sales.

That may no longer be the case as gas prices are climbing again.

The average national gas price hovered around $3.50 on January 27, up more than ten cents over the prior week and forty cents compared to the end of December.

Here’s what AAA spokesperson Andrew Gross said:

“The recent rising temperatures led to rising pump prices. And with the cost of oil hitting $80 a barrel, there is a lot of upward pressure on gas prices at the moment.”

If this trend continues, we may see lower interest in larger trucks and SUVs, which means you’ll probably make less when you sell.

And gas prices will only go up as people begin to travel in the spring. So if you’re considering selling a gas guzzler, this may be the time to do it.

What’s the Verdict?

Probably not the best month to buy a new car. Personally, I’d wait until they introduce some discounts and promotions.

Not a bad month to buy a used car, though. Prices are still higher than they historically should be but much lower than they were for the past nine months or so.

And if you’re selling, things are better than they have historically been, not as good as they were six months ago, but probably better than they’re going to be in the next six or so months.