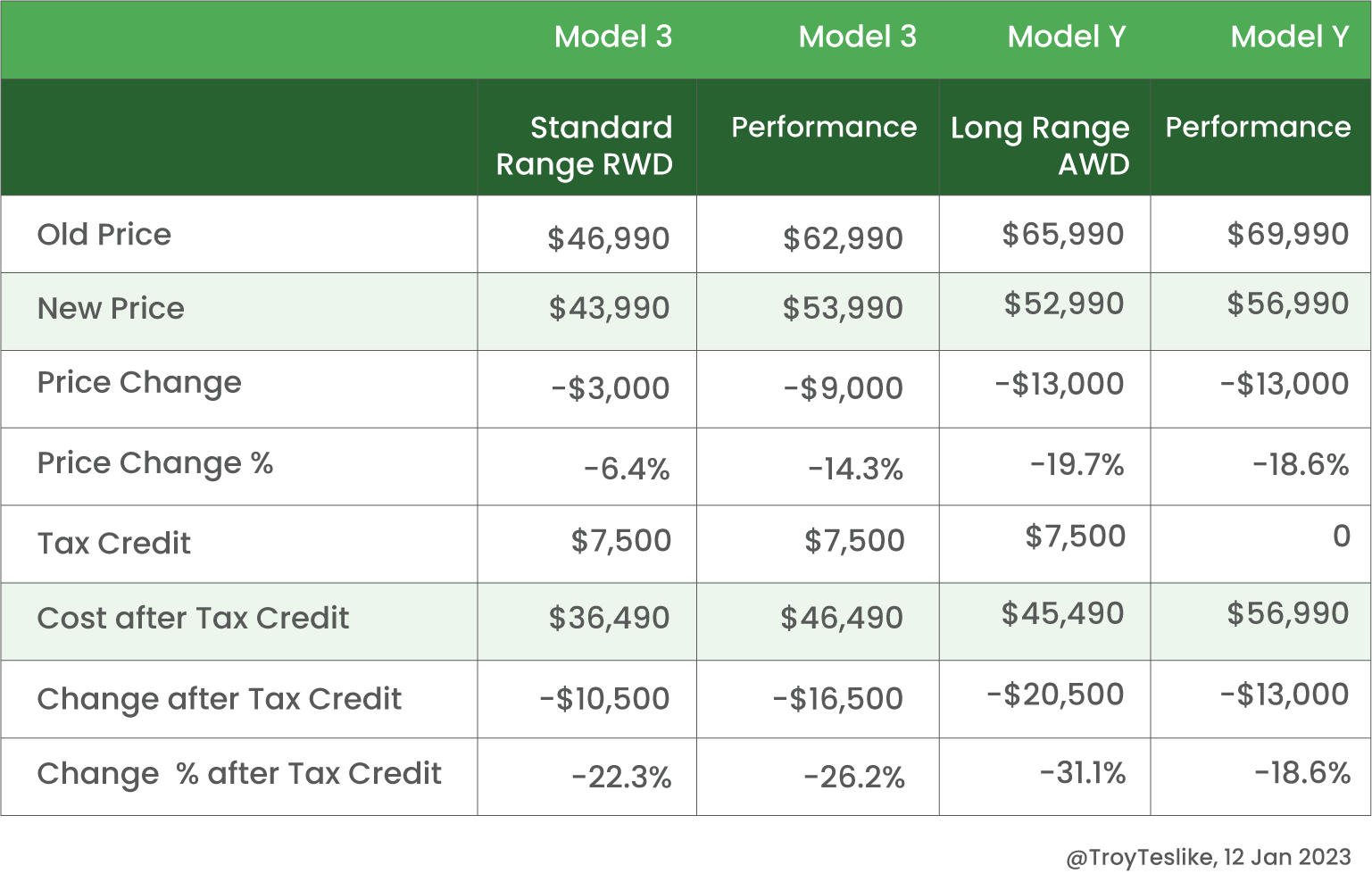

Tesla just dropped the Model Y price by $13,000, which means it now qualifies for the $7,500 EV Tax Credit.

Last year people were making money flipping Teslas like they were on HGTV, but this Tesla price drop has made the car more affordable than ever.

Here’s the kicker, the Tesla price drop means three models qualify for up to $7,500 in EV Tax Credits.

The Tesla Model Y, which cost more than $65,000 just a few weeks ago, now costs $52,990. And the reduced price comes with up to $7,500 in tax credit which translates to more than $20,000 in total savings.

Bloomberg talked to several recent buyers about the Tesla price drop, and they were unhappy.

Imagine paying $65,000 on a Tesla Model Y earlier this month. That means no savings and no tax credit.

Or, imagine you were trying to sell your lightly used Tesla just to be undercut by the manufacturer.

To qualify for the EV tax credit, you must buy a qualifying EV that costs less than $55,000 (or $80,000 for trucks and vans). You must also make less than $150,000 individually or under $300,000 married filing jointly.

Not all EVs under $55,000 qualify because of additional manufacturing requirements written into the law, but you can find the details on the IRS’s EV Tax Credit webpage.

The company gave no specific reason for the Tesla price drop, but most analysts point to two factors.

Tesla’s EV market share dropped from 72% to 65%. And while those problems can be attributed to several internal factors (PR problems, vehicle performance issues, price), it’s largely the result of more manufacturers making EVs. This year is the first year that most auto manufacturers in the US offer an array of EV options. So the price drop is a move to boost sales.

They may not have announced this intention, but the Tesla price drop situated three Tesla models just within the price cutoff to qualify for the EV Tax Credit. By qualifying for additional savings, Tesla gives potential buyers one more reason to choose Tesla.