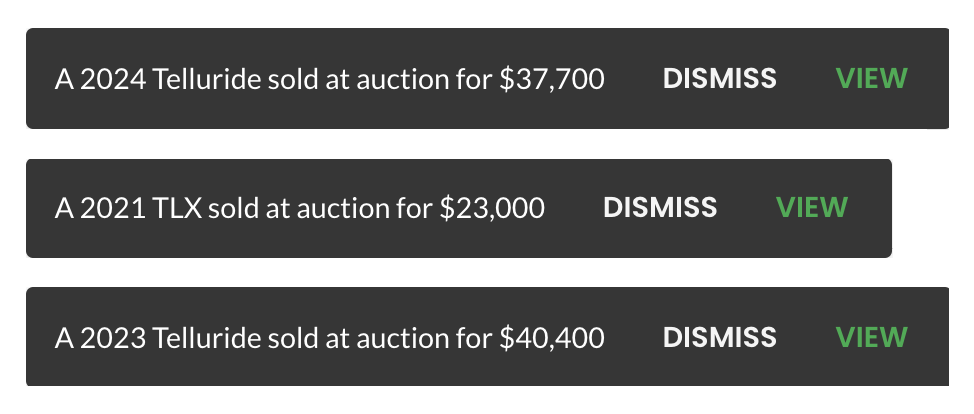

Carmigo now accepts floor plan pricing through CarBucks. No more waiting to reserve the necessary stock you need for your dealership due to pricing limitations.

CarBucks is a viable solution if you are a dealership looking for quick cash flow, and offers great terms that you won’t find with other floor plan financing. They have a simple application process, transparent pricing, and competitive terms. In fact, their plans have no curtailments for maximum cash flow–up to 180 days.

Carmigo is excited to partner with CarBucks to offer these flexible finance options to our dealers. We believe their transparency and “customer-first” approach aligns well with our own company values, and will further aid us in making wholesale as easy as possible for dealerships.