How Much Money Can You Make if You Sell Your Car?

Do you ever wonder how much money you would make if you sold your car today? To know that, you’ll have to determine how much equity you have in your car. Your car’s value, and how much money you’d make if you sold it are two different things. Let’s start with a definition.

Equity: It’s the value of your ownership stake in an asset. More simply, how much you can get paid for something you own.

So let’s find out how to determine equity in your car.

What’s It Worth?

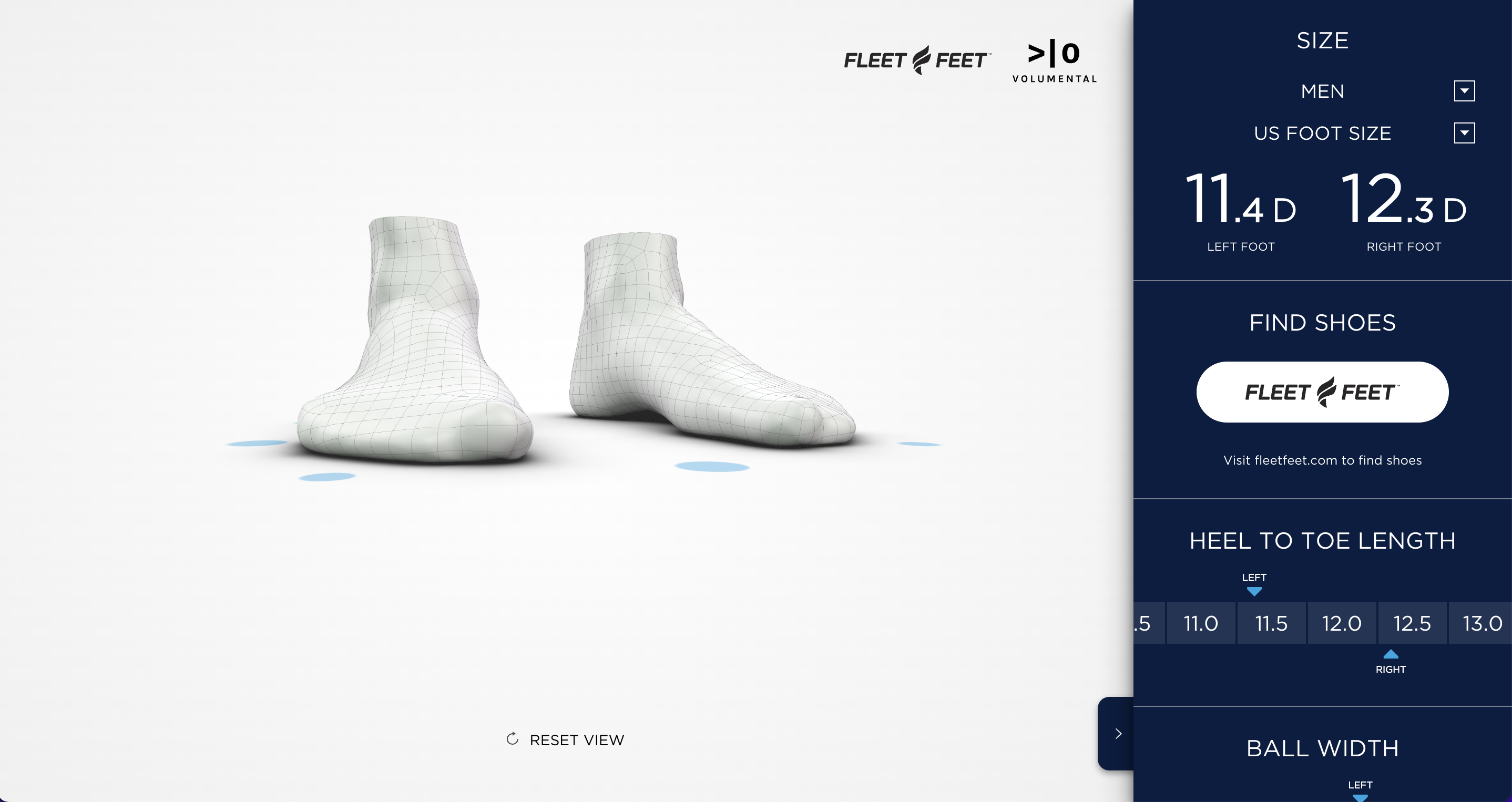

First things first, we need to find out how much your car is worth. This is easy enough to do on a number of websites, like Kelley Blue Book.

What Do You Owe on Your Car Note?

Your loan payoff amount could be higher than your loan balance depending on interest and early payoff penalties. Call the bank that holds your auto loan and they’ll be able to tell you exactly how much you’ll owe if you pay in full.

Since your lender is likely holding the title to your car until the loan is paid in full, you’ll need to pay this off immediately when selling your car.

Other Considerations?

Are there any other liens against your car? For instance, did you use your car to secure a personal loan from your bank or a cash-for-title loan? In the same way you checked your car note’s payoff amount, see how much it will cost you to pay off these loans. These will also have to be paid when you can sell.

How to Determine Equity in Your Car

Now for the math, but don’t worry. This is one of the easiest math problems you’ll ever have to do. Add up everything you owe, and subtract it from your estimated sale price like so:

Value – (Car Note + Lien) = Equity

If your car is worth more than you owe, congrats. You’ve got equity in your car, which means you’ll have money left over after the sale.

With a little bit of saving you may be able to sell your car and pay all your loans in full just in time to shop for a new one. Or you may want to wait until you’ve made a few more monthly payments.

Shameless Plug: Either way, when you’re ready to sell, we’ll make it easy.

make-it-easy salute to

make-it-easy salute to