Used car sales slowed a bit last month as the gap widened between what sellers were asking and what buyers were willing to pay.

This disparity is partially due to increased supply and partially due to a lagging seller’s market.

The supply of used and new cars is up, but the list price has remained relatively unchanged which could be part of the reason the number of sales has declined.

We’re seeing similar things on the Carmigo marketplace. Car owners still want to cash in on the used car gold rush from this summer, but used car dealers and private buyers just won’t pay those prices with so many other options.

“The average listing price for used vehicles continues to trend at just over $28,000, but the price growth has definitely come down since we passed the anniversary of last year’s big run-up,” said Chris Frey, Cox Automotive’s senior manager for Industry Insights. “Still, prices remain above 2021 levels and will stay there as demand remains strong and until new-vehicle inventory builds.”

Sales are actually 16 percent lower than this time last year with prices nearly 10 percent higher.

The high prices combined with 10% more used cars on the market last month meant fewer people were willing to buy cars without getting a discount on the asking price.

In a recent Cox Automotive survey, private and franchise dealership described their used car inventory levels as being better than in previous months, but the overall used car sales environment as worse.

Business Wire reported average used car prices more than 30% higher than projected normal levels even after dropping significantly in the last month.

Even as prices go down, it’s important to remember they are still much higher than normal.

Think about gas prices coming out of the pandemic. The price of a gallon of gas dropped at first because no one was buying gas. Then prices soared to record because there wasn’t enough gas around the world. And finally, gas prices have gone back down drastically. But we’re still paying a lot of money for gas, nearly $3.75 per gallon.

The used car market is similar. No one bought cars in the early months of the pandemic. Then it seemed like everyone did, at the same time factories were shut down and there was a global lack of car parts. So prices soared. Now they’re less than the record highs but still high.

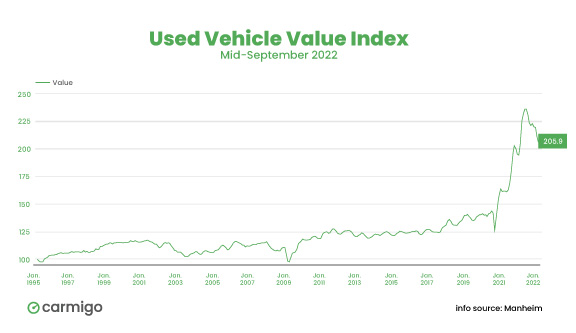

The Manheim Used Vehicle Value Index, which serves as a decent summary of the overall used car market, had the market at a 205 rating. That’s lower than the 236 rating in January (an all-time high) but still much higher than the 141 rating in January 2020 before the used car market went haywire.

If you sell a used car in October, you’ll probably get less than you would have two or three months ago, but it’ll still be one of the best deals you’ve gotten if you’ve sold a car before.

With much of the auto manufacturing industry back online, more cars are being made, meaning more cars are available — new and used.

The rise in used car prices this summer was in large part driven by buyers who wanted new cars but couldn’t find them. Now that new cars are available, that segment of the market is no longer buying used.

That means used car dealerships are in less of a hurry to buy more used cars (they have plenty).

During the height of the used car market boom, buyers were paying more for used cars than the MRSP of a newer year of the same model. That’s because the new models were unavailable or on backorder. Now that buyers can pay close to the list price for a new car, they no longer need to pay above the list price for a used car.