It’s June 2023 and the average new car-payment is more than my first mortgage payment but that’s not slowing sales.

And even with new car prices at an all-time high, used car sales are back on the downslope.

But, what we’re seeing is actually the market rightsizing after the pandemic caused a couple of wild years in the car market.

So, as crazy as the market seems now, this is all ok.

Plus, we’re finally seeing some manufacturer incentives on new cars to help combat the astronomical prices they’re charging.

Before we go any further, here are the cars selling best and worst on the Carmigo Marketplace going into June:

You can read more about each of these models and why we chose it for the list over at the Red Light x Green Light report.

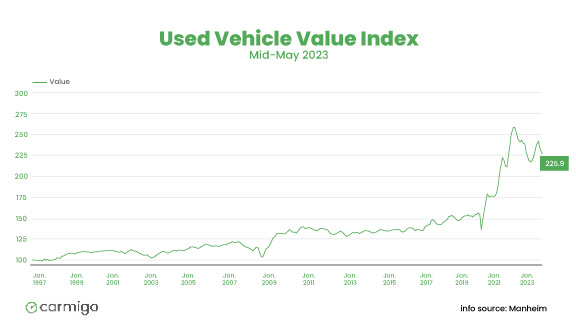

The used car market looks to have continued its return to the mean, which paused briefly this spring.

When we talk about free market capitalism and letting the markets decide, this is that. Markets don’t go up forever. Even Steph Curry misses shots sometimes.

Used sales and prices have held pretty solid over the past few months, considering the volatility in the market since the beginning of the pandemic supply shortages.

I’ve always lived near the gulf coast, home of oil companies and hurricanes.

After a major hurricane disrupts gas supply, gas prices go up fast. But sooner or later, supply catches back up through a combination of repairing the storm damage and of folks using less gas due to prices.

Going into the Pandemic, in 2020, the manheim index was around 150, steadily rising a couple points most year.

But when new cars stopped being made during the pandemic, used car prices skyrocketed, higher than they’ve ever been. Just like with gas, those numbers are going to end up going back down sooner or later.

And this is a fairly steady return to the mean, which is the best we can hope for.

While no one wants to sell as a market is on the way down, it’s not going back up anytime soon. So if you’ve got to sell a used car, now is as good a time as any.

The average used vehicle listing price was $26,969 going into last month, the highest since the beginning of 2023, but that’s still down 4% from last year.

This could be due partially to a preference for inexpensive used vehicles. With vehicle prices near all-time highs, people are reaching for the cheap stuff.

Days’ supply for under $10,000 vehicles was 31. Days’ supply for vehicles priced between $10,000 and $15,000 was 37, between $15,000 and $20,000 was 40 and $20,000 to $35,000 was 44. Vehicles priced above $35,000 had the highest days’ supply at 46.

Cox predicted May would see 20% increase in new vehicle sales, and their predictions were beaten. I totally didn’t expect to see new sales to continue going up because of prices and continually increased availability.

But, I’m not the expert, Charlie Chesbrough is. He broke it down in a way I hadn’t considered last month:

“New-vehicle sales will show strong gains this month over last year’s levels, and on the surface, this is a bit surprising. Interest rates are substantially higher than a year ago, as are vehicle prices, and yet sales will increase year-over-year. The reason? Vehicle shoppers now have a much better chance of finding something that fits their needs. Pent-up demand, held back by limited product availability last year, is now being fulfilled as inventory levels improve around the country.”

People couldn’t buy new inventory because it wasn’t available, and now that it is, people are buying the cars they saved up for, even if its way more expensive than it was a few years ago.

“New-vehicle inventory continues to improve, supporting a pick-up in the sales pace,” said Charlie Chesbrough, Cox Automotive senior economist. “Clearly, pent-up demand is being unleashed. How much pent-up demand exists is the question. We still expect sales to slow in the second half as economic headwinds, particularly rising interest rates, grow.”

I’m still skeptical about how sustainable this trend is because the affordability index is getting a little out of control.

The average list price for a new car is now above $47,000, which brings the average monthly payment on a new car loan to more than $700.

New car prices may be at record highs, but at least manufacturers are beginning to issue discounts.

The average total incentive is higher than it’s been in the past year, coming in at $1,714 per vehicle.

New vehicle prices are slowly ticking down after reaching all-time highs this winter. But those dips aren’t enough to boost sales, which dropped slightly to just under 1.3 in April.

At the same time, new car inventory has basically returned to pre-pandemic levels, meaning that long waiting lists are no longer propping up new car prices, and manufacturers are introducing incentive pricing.

New car prices will likely continue to ease, but new car sales should continue to benefit from the current highs.